The crypto industry is far from taking major hits. Previously Terra, Three Arrows, and many other leading firms in the industry imploded, and the industry experienced the FTX saga. Sam Bankman-Fried’s fall from grace after the collapse of FTX, the saga renewed the famous meme “Hold my beer.”

It was previously revealed that SBF left a $10 billion hole in one of the most trusted crypto exchange platforms, FTX. It might take some time before the public is made aware of how much the damage is and what exactly happened.

Trusted Third Parties are Security Holes

Satoshi Nakamoto published the Bitcoin Whitepaper 14 years ago and he outlined a blueprint for “a purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.” However, crypto did a full circle and most of its trading activities took place in centralized exchanges.

Satoshi’s main aim for creating Bitcoin was to eliminate the use of third parties from the financial systems. It was believed that Satoshi’s idea was wonderful and many people backed him up. Unfortunately, he wasn’t the first person to come up with this genius idea. In 2001, Nick Szabo published an article titled, “Trusted Third Parties are Security Holes.” In this article, he explained the dangers of building financial systems that depend on third parties and the need to build systems that aren’t.

Eventually, Satoshi created an alternative, Bitcoiners understood his idea, held onto it and publicized it to the masses. “Not your keys, not your coins” became a mantra for the space, aiming for the need to self-custody crypto instead of relying on centralized intermediaries. Still, many chose to ignore the advice despite numerous warnings such as the Mt.Gox and QuadrigaCX blowups in 2014 and 2019. In 2022, crypto enthusiasts and veterans have had their fortune wiped out by other crypto scams involving crypto exchanges and lending platforms.

Not only did people choose to not vet and ‘verify’ these platforms, but they blindly trusted these untransparent and risky businesses. Billions of dollars were stolen by egomaniacs, while the crypto industry did nothing to end this. People acted all shocked–as if Satoshi had not pointed out these risks in his article.

The worst part about this whole FTX debacle is all the red flags were there for all to see.

The Red Flags in the FTX Saga

Sam Bankman-Fried, commonly known as SBF in the crypto circle made his way into the industry in 2019 after founding FTX. He quickly rose to fame and became a darling to the media without showcasing any proof of his previous works. By 2022, he had reached billionaire status after his wealth was valued at $32 billion.

SBF spent the entire 2022 period plastering his image on billboards advertising FTX, interacting with politicians, and lobbying for the regulation of the Digital Commodities Consumer Protection Act (DCCPA) bill, that if enacted, would kill decentralized finance. In simple words, he weaseled his way to the top and wanted to sabotage other key players in the industry.

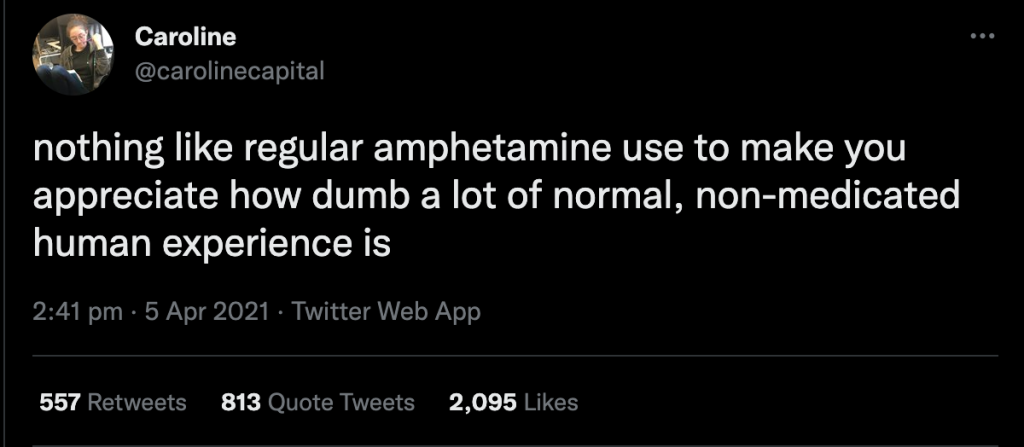

SBF oversaw FTX, while Alameda Research was led by Caroline Ellison. She is a 28-year-old with only 19 months of prior experience as a junior trader at Jane Street. In 2021, Ellison sparked controversy when she tweeted “Nothing like regular amphetamine use to make you appreciate how dumb a lot of normal, non-medicated human experience is,”

A year later, Ellison found herself at the epicenter of the FTX scandal. The scandal revealed that SBF moved $10 billion in customers’ money. His reason for doing this was to save Alameda from its impending insolvency crisis. Sadly, many more shenanigans from the two might surface while others may not.

Unfortunately, there are still many red flags across the industry.

We Simply Never Learn

The FTX collapse is nothing new. This is why Satoshi invented Bitcoin to eliminate the abuse of money, power, and trust. The collapse of Mt. Gox, QuadrigaCX, Voyager Digital, Celsius, FTX, and BlockFi are just the same cycles repeating themselves. The crypto industry is reproducing the worst aspects of the finance industry that it sought to do away with. Fortunately, the government and central bank balance sheets won’t be there to cushion the blow as has been in the conventional world.

Crypto enthusiasts received the “I told you so” and “crypto is a scam” statements from the noncoiners. However, it’s important to note that FTX was a regulated business under the full law and laws and regulations. These same laws promote the same off-shore jurisdictions politicians that promote these nonsense mantras leverage to hide their wealth. In other words, FTX, a regulated business did something illegal but the irony is the regulators never caught them in the act. Weird, right?

Two Lessons to Be Learned in the FTX Fiasco

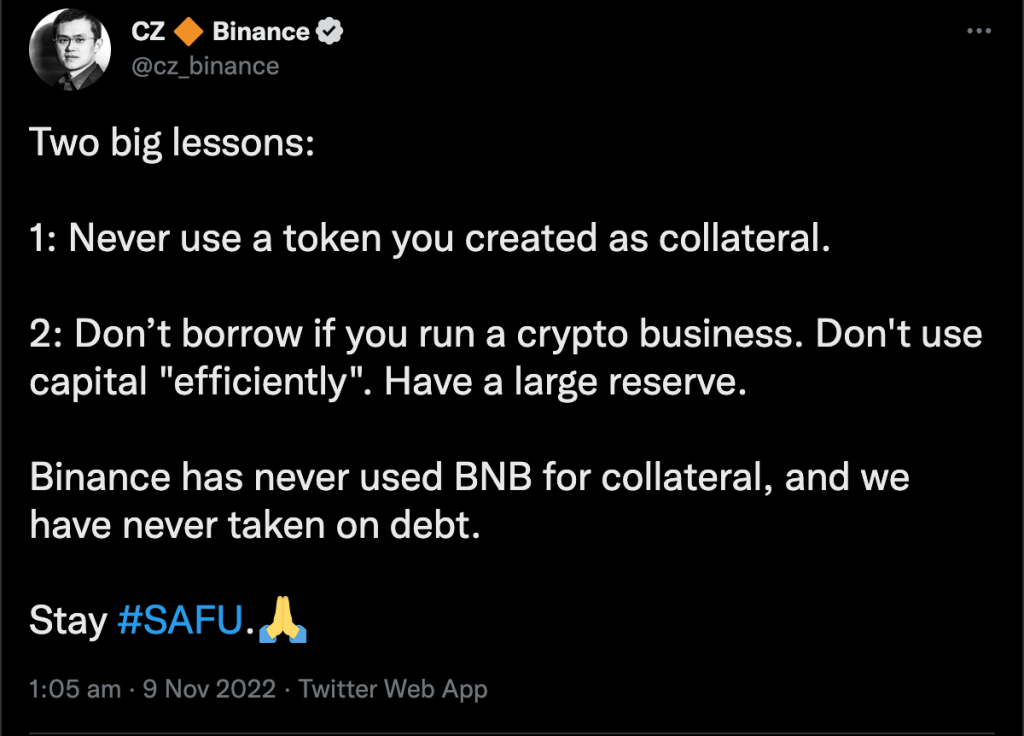

Binance CEO, Changpeng “CZ” Zhao took to Twitter to share two major lessons after the collapse of FTX. He stated that a firm should not use its token as collateral. He added that Binance never uses its token as collateral. FTX’s liquidity issues came from CZ’s tweet on November 6 saying that Binance would be liquidating its holdings of FTX Token. Binance does not fully disclose what reserves it uses as collateral. However, CZ claimed that he would soon share with the public about their reserves.

CZ’s second lesson was that businesses should not be borrowing and instead should opt to maintain large reserves. This statement was made in reference to FTX’s sluggish withdrawals that were evident on November 7. Eventually, this sparked rumors that the firm did not have enough money to cover user funds.

Cryptocurrency is a risky investment and should be treated as so. With the collapse of FTX, it’s evident that those who lost failed to learn from the lessons they already knew: don’t ignore red flags; don’t trust, verify; and always self-custody your assets.