In the United States banks use an electronic network for dealing with financial transactions. The Automatic Clearing House (ACH) offers a secure way for these institutions to deal with each other. The system has been in operation since the 1970s. It is regulated by the National Automated Clearing House Association and the Federal Reserve. It was established as a more effective way of dealing with transactions between banks; it has largely replaced check payments which was the old way of doing things.

How the ACH Works

The Automatic Clearing House is able to handle a number of different financial transactions including:

The Automatic Clearing House is able to handle a number of different financial transactions including:

- Business to business payments

- Tax payments (federal, state, and local)

- Direct deposit of payroll

- Government payments such as social security

- Bank treasury management

- Ecommerce transactions

- Vendor payments

- Point of purchase check conversion

- Bills and mortgage payments

Any ACH transaction involves the receiver granting permission for another party to either debit or credit their account. In order to make the transaction the receiver will need to provide their account number and routing number. The receiver can be anyone who has an account, but they must first give permission to allow the transaction first of all.

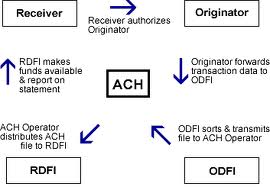

The ACH is unable to function properly without the assistance of some other parties. The originator refers to the party that requires the transaction; for instance this could be a shop looking to deposit a check from a customer into their own account. In order to get this check cleared through ACH it needs to go through a Receiving Depository Financial Institution (RDFI). This could be any bank that is signed up to the ACH system.

In order to better understand how Account Clearing House transactions work it may help to look at an example of it in action. If you were to go into a sports shop and purchase a pair of runners for $70 you could write a check for this amount. By writing this check you are the receiver and you are giving the originator permission to withdraw money from your account. You give the permission to do this by signing the check. The information you have provided will allow ACH to know which account to debit this money from so that the sports shop can get paid.

Some Final Thoughts on ACH

The original aims of ACH were quite modest. In the 70s it was only ever intended to deal with check payments. Since that time the rise of electronic payments has been spectacular and now the system has to deal with a tremendous amount of traffic. So far the system seems able to grow alongside the increasing demand for it. This is good news because our expectations today are a lot higher than then were forty years ago when it comes to the transfer of money between accounts. We have grown to rely on money moving quickly and it is hard to imagine how we would manage in our modern world without this.